The ARR Trap: What Every Tech Investor Should Know Before Backing an AI Startup

As tech investors, we’re constantly on the lookout for the next transformative wave—and right now, that wave is undeniably AI. But as we evaluate emerging AI startups, it’s important to scrutinize a familiar metric that can be deeply misleading in this space: ARR, or Annual Recurring Revenue. While ARR is a cornerstone in traditional SaaS evaluations, its application in AI can be fraught with hidden pitfalls.

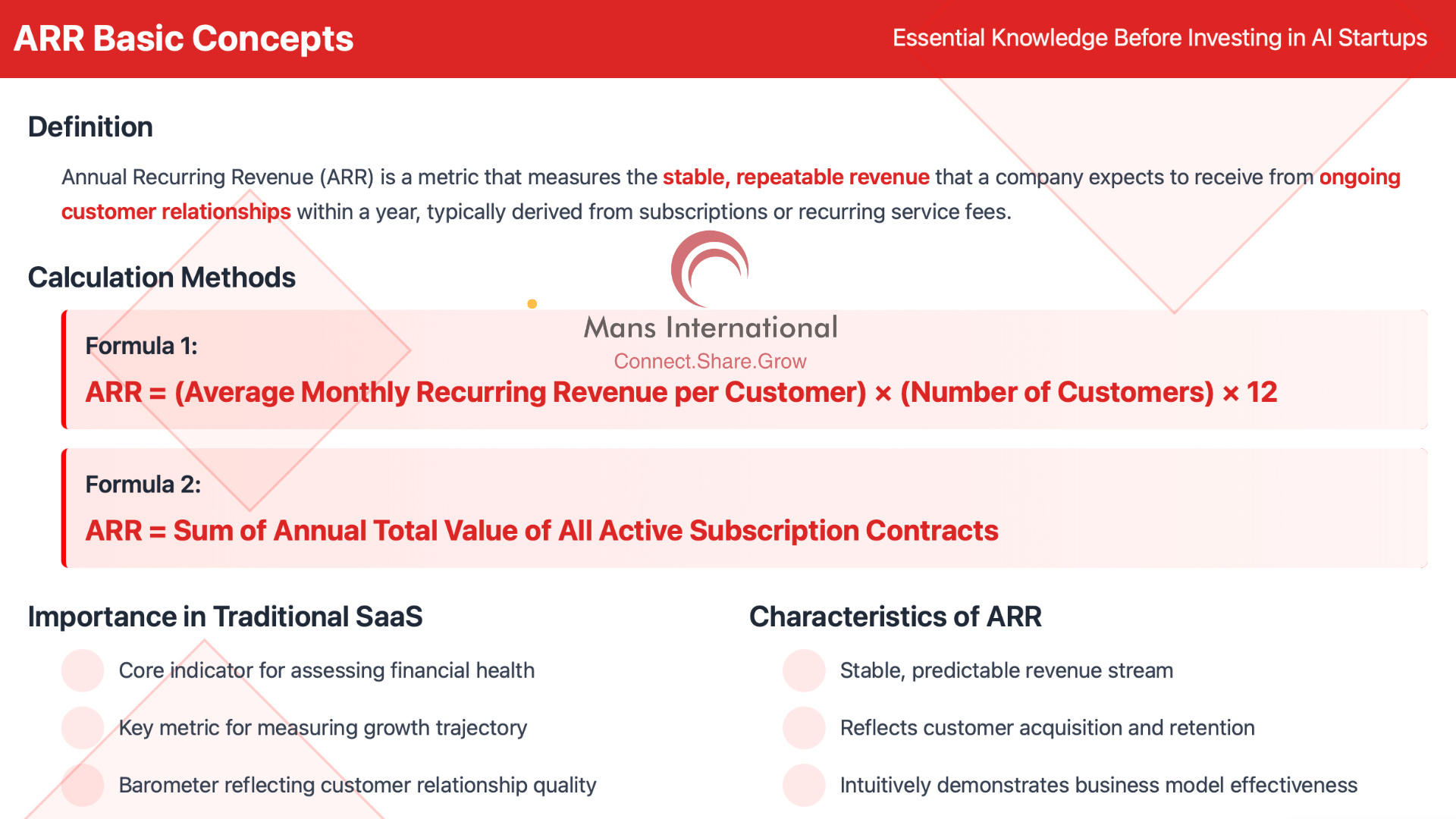

ARR in a Nutshell

ARR, or Annual Recurring Revenue, is a metric that estimates the stable, repeatable revenue a company expects to generate in a year from ongoing customer relationships, like subscriptions or recurring service fees.

Calculating ARR is straightforward in a pure SaaS world.

Formula: ARR = (Average Monthly Recurring Revenue per Customer) x (Number of Customers) x 12

Or, more simply: ARR = Sum of all active subscription contracts’ annual value

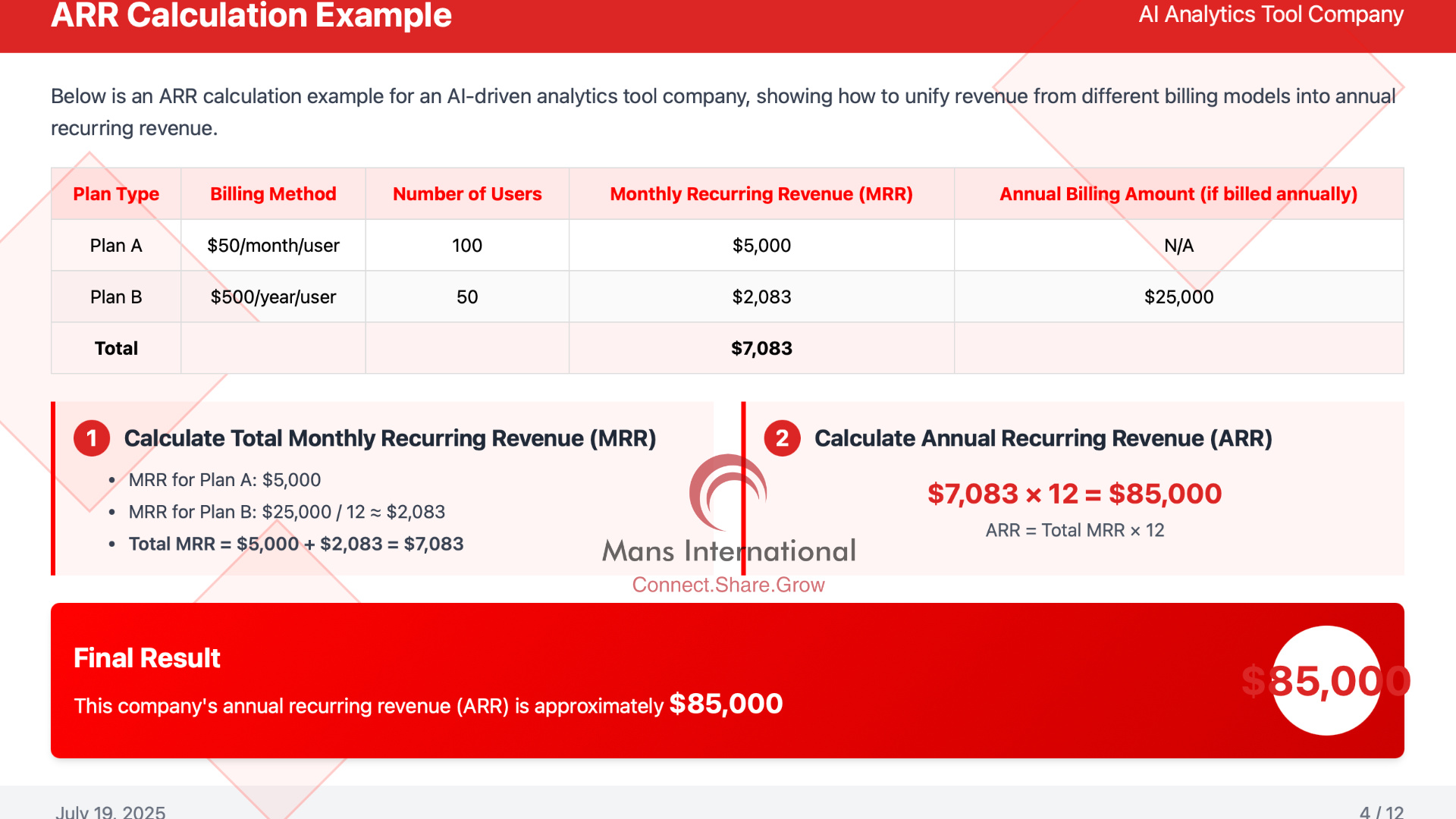

Example:

A startup offers an AI-powered analytics tool with two pricing plans:

- Plan A: $50/month per user (billed monthly)

- Plan B: $500/year per user (billed annually)

At the end of June, the company has:

- 100 users on Plan A → MRR = 100 × 50=50=5,000

- 50 users on Plan B → Annual billed amount = 50 × 500=500=25,000

Step 1: Calculate MRR

- From Plan A: $5,000

- From Plan B: 25,000/12months= 25,000/12months= 2,092/month

Total MRR = 5,000+5,000+2,092 ≈ $7,092

Step 2: Calculate ARR

ARR = 7,092×12≈∗∗7,092×12≈∗∗85,104**

So, this company’s Annual Recurring Revenue is approximately $85,104.

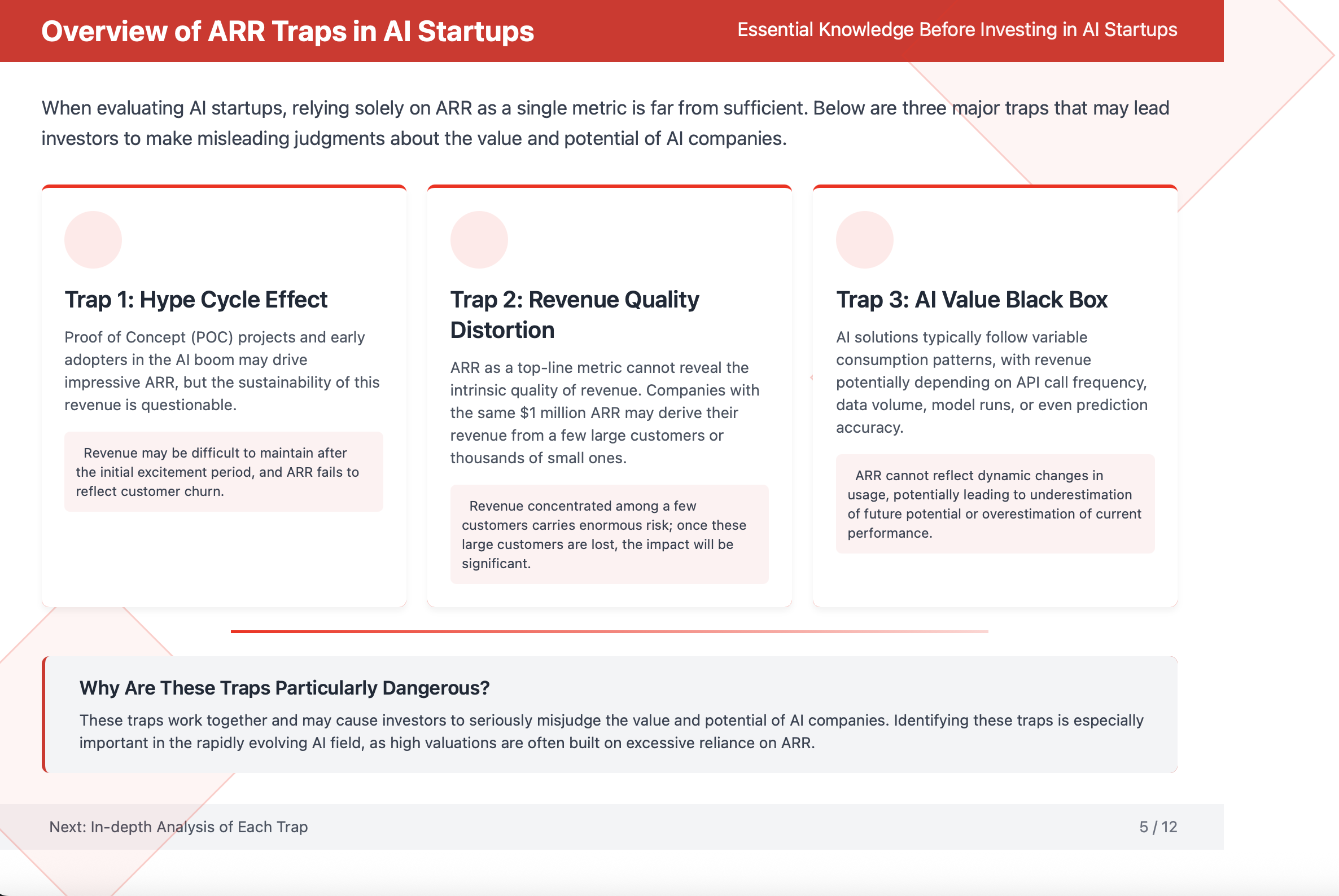

The 3 ARR Traps Every AI Investor Should Know

Trap #1: The “Hype Cycle” Effect and Proof-of-Concept Revenue:

In the current AI boom, some companies may report impressive ARR numbers driven by proof-of-concept (POC) projects or early adopters caught up in the hype. However, this revenue may not be sustainable if the AI solution fails to deliver consistent, measurable ROI beyond the initial excitement. ARR also doesn’t account for customer churn.

Moreover, ARR can distort the quality of revenue. For example, a company reporting $1 million in ARR may have secured it from a handful of large clients—or from thousands of smaller ones. The former carries significantly higher risk due to revenue concentration, even though the top-line ARR appears the same.

Trap #2: The “Black Box” of AI Value and Usage-Based Models

Some companies inflate their ARR by including one-time fees or by using a single month’s MRR—often boosted by temporary promotions—and then simply multiplying it by 12, misrepresenting the true recurring revenue potential.

Furthermore, unlike traditional SaaS models with relatively stable usage patterns, AI solutions often follow variable consumption models. Revenue may depend on factors such as API calls, data volume, model runs, or even prediction accuracy. In these cases, ARR—a fixed annual figure—fails to reflect the dynamic nature of usage.

This creates two potential blind spots:

- A low ARR might underestimate future upside if the AI solution delivers strong value and usage scales rapidly.

- A high ARR from a fixed subscription might overstate performance if the solution is underutilized or fails to deliver meaningful results.

Trap 3: R&D and Deployment Costs Masked by Revenue

ARR doesn’t reveal how much it costs to acquire or retain that revenue—key metrics like CAC and gross margin are left out.

AI companies often face substantial and ongoing R&D expenses to improve models, develop new algorithms, and maintain technical leadership. On top of that, infrastructure costs (e.g., compute, data labeling) and complex deployments can be significant, often requiring costly professional services.

As a top-line metric, ARR ignores these hidden costs. A company may report high ARR but still operate with thin or negative margins, making ARR a poor indicator of true financial health.

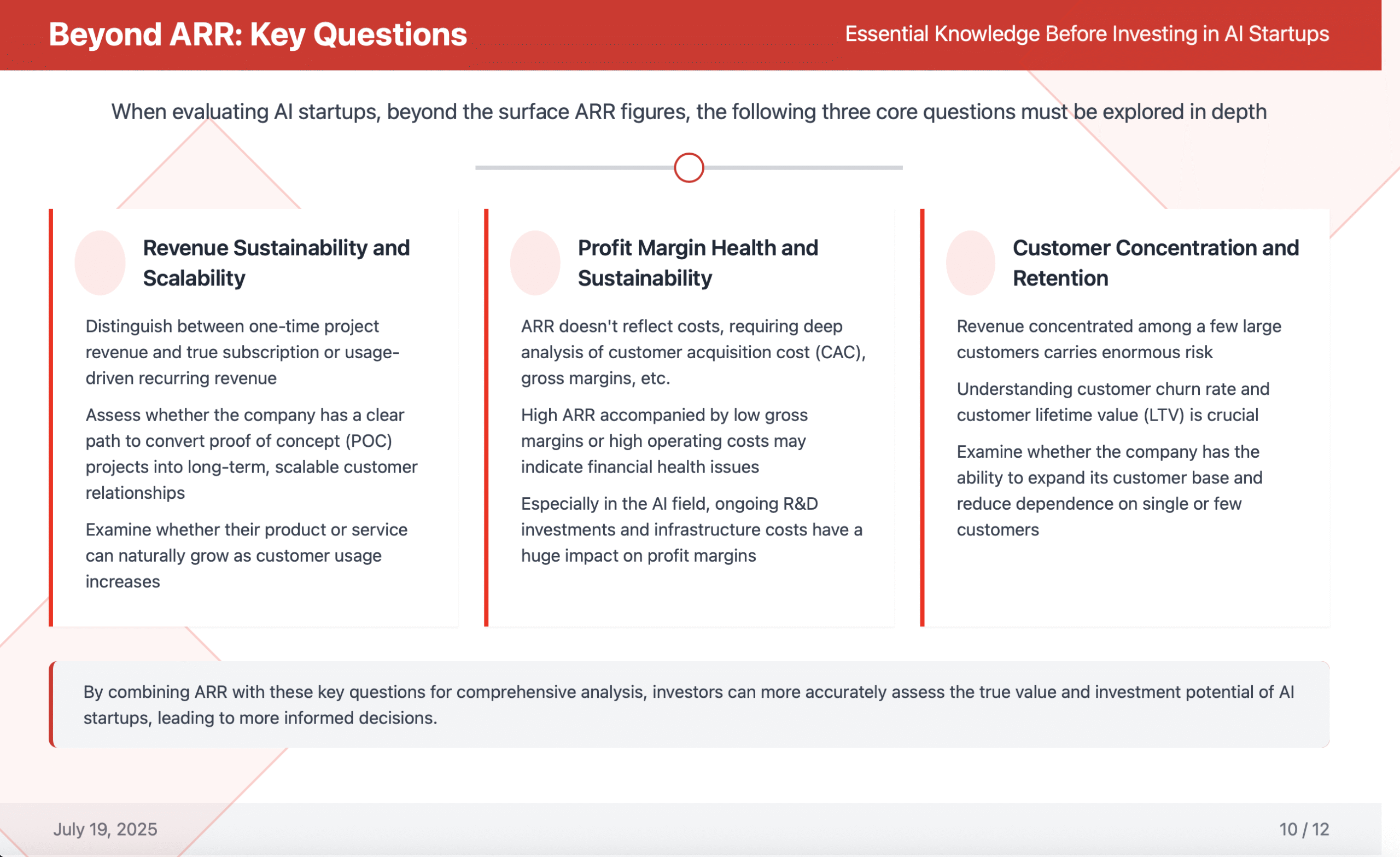

Summary: Look Beyond the ARR Headline

Smart investing requires more than surface-level metrics—and in AI, the story behind ARR matters more than the number itself.

ARR can be a useful signal of traction and pricing power, but it must be viewed in context. Always ask:

- Is the revenue truly recurring and scalable?

- Are margins healthy and sustainable?

- What’s the customer concentration and retention profile?

The key is to recognize ARR’s limitations and pair it with a holistic view of the company’s business model, cost structure, and real-world performance. Only then can you make informed, high-conviction investment decisions in the AI space.

Stay Ahead in the AI Era

If you’re ready to move beyond surface-level metrics and cultivate a truly insightful understanding of AI innovations, the dynamic startup landscape, and practical use cases and applications, we invite you to sign up for our weekly intelligence sharing session. Equip yourself with the knowledge to navigate and conquer the AI frontier.

Course Features

- Lectures 0

- Quizzes 0

- Skill level All levels

- Language English

- Students 3251

- Assessments Yes